29+ Irs Nonfiling Letter

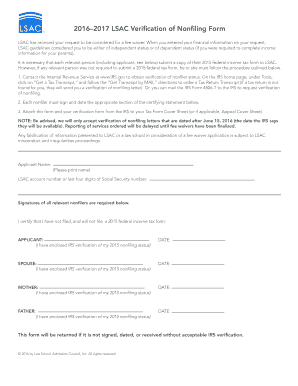

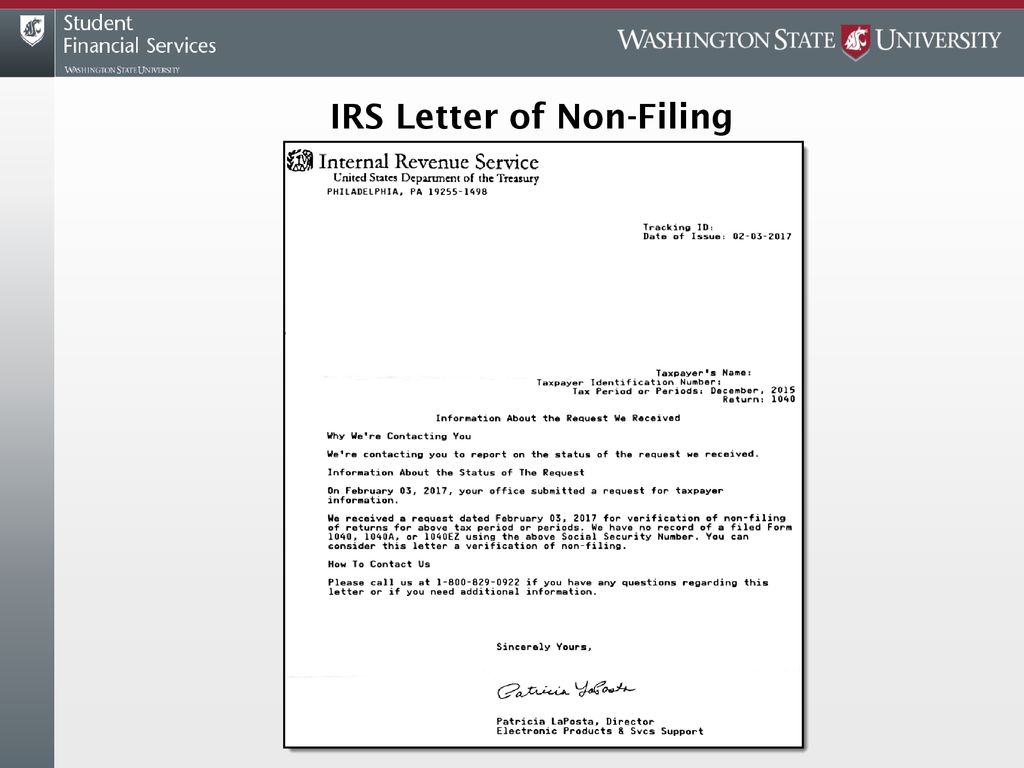

Web An IRS Verification of Non-filing Letter provides proof that the IRS has no record of a filed Form 1040 1040A or 1040EZ for the year you requested. Web Select Verification of Non-filing Letter and in the Tax Year field select 2019.

Non Filing Letter Sample Fill And Sign Printable Template Online

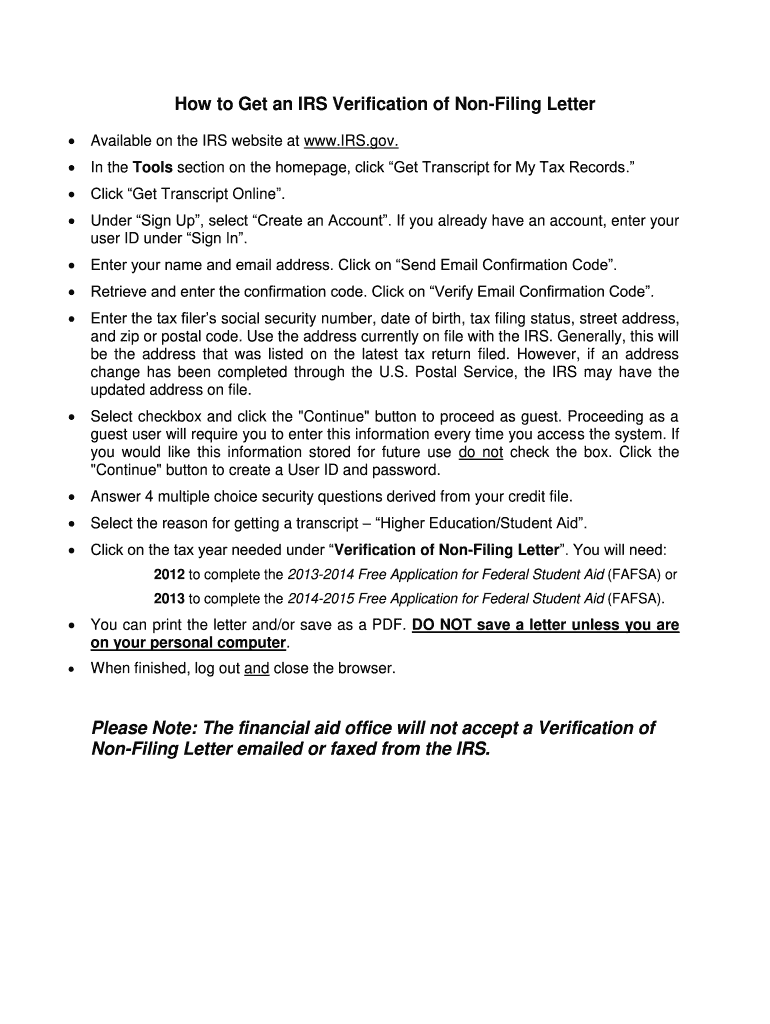

There are four ways to do this.

. Sign and submit the IRS Verification of Non-filing Letter to Humboldt State University. Web IRS Verification of Nonfiling Letter. Web How to Request the IRS Verification of Non-filing Letter.

If successfully validated you will be able to view your IRS Verification of Nonfiling letter. Web Each nontax filer is required to provide the letter. The Department of Education DOE requires that people who do not file taxes to verify their non-filing status to the college or university.

Provides non filers with the option to have their IRS Verification of Non. Web Download IRS Form 4506-T Complete Lines 1 4 following the instructions on page 2 of the form. If youre trying to secure college financial aid or determine your federal aid eligibility through a Free Application for.

Upload the document when prompted when submitting. Web Select Verification of Non-filing Letter and in the Tax Year field select 2016. Web IRS Verification of Non-Filing Letter October 2020 Students who apply for financial aid who did not file a tax return for the requested year may be asked to submit verification of Non.

Get Transcript by Mail Go to irsgov and click Get Your. Web Select Verification of Non-filing Letter and in the Tax Year field select 2019. Make sure to include the students name and Student ID number on the letter.

Web How to request a Verification of Non-Filing Letter online The easiest and quickest way to obtain your Verification of Non-Filing Letter is by logging on to you or. Web You can get a Verification of Non-filing Letter by requesting a tax transcript from the IRS. If we are requesting a tax transcript for verification or any other reason but you your spouse or your parent s did not file.

Non Tax filers can request an. Web Select Verification of Nonfiling Letter for the correct tax year ie. Web If the 4506-T information is successfully validated tax filers can expect to receive a paper IRS Verification of Nonfiling letter at the address provided on their request within 5 to 10.

Non-Tax filers can request an IRS Verification of Non. Web Method 1. To request a IRS Verification of Non-filing Letter visit.

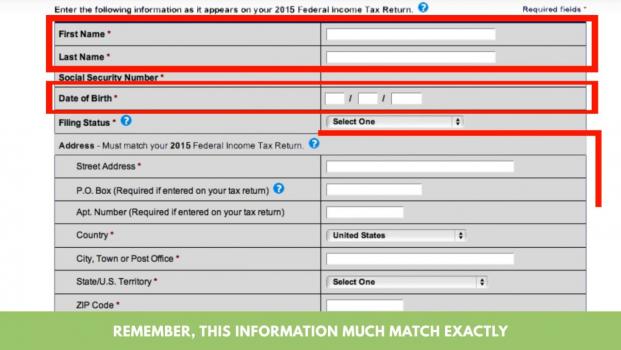

Sign and submit the IRS Verification of Non-filing Letter if requested to Marquette Central. ONLINE REQUEST Go to httpswwwirsgovindividualsget-transcript Click Get Transcript ONLINE Enter the non-filers Social Security Number. Web An IRS Verification of Non-filing Letter - provides proof that the IRS has no record of a filed Form 1040 for the year requested.

If successfully validated you will be able to view your IRS Verification of Non-filing Letter. Web Sign the IRS Verification of Non-filing Letter. Web IRS Verification of Non-Filing Letter.

Irs Verification Of Non Filing Letter Tiktok Search

9 7 2 Civil Seizure And Forfeiture Internal Revenue Service

How To Request A Verification Of Non Filing Status Youtube

Help R Irs

Affordable Care Act Requirements Still Enforced Irs Esrp Letters Continue

Irs Letter 4903 No Record Of Receiving Your Tax Return H R Block

Free Response To Irs Notice Make Download Rocket Lawyer

Letter Of Verification 29 Examples Format Sample Examples

Why Am I Receiving Letter Under My Return Transcript For 2022 R Irs

What To Do If You Receive An Irs Identity Verification Letter Cpa Practice Advisor

How Do I Request An Irs Verification Of Non Filing Letter As Usa

9 7 13 Title 26 Seizures For Forfeiture Internal Revenue Service

Request A Tax Transcript Lane Community College

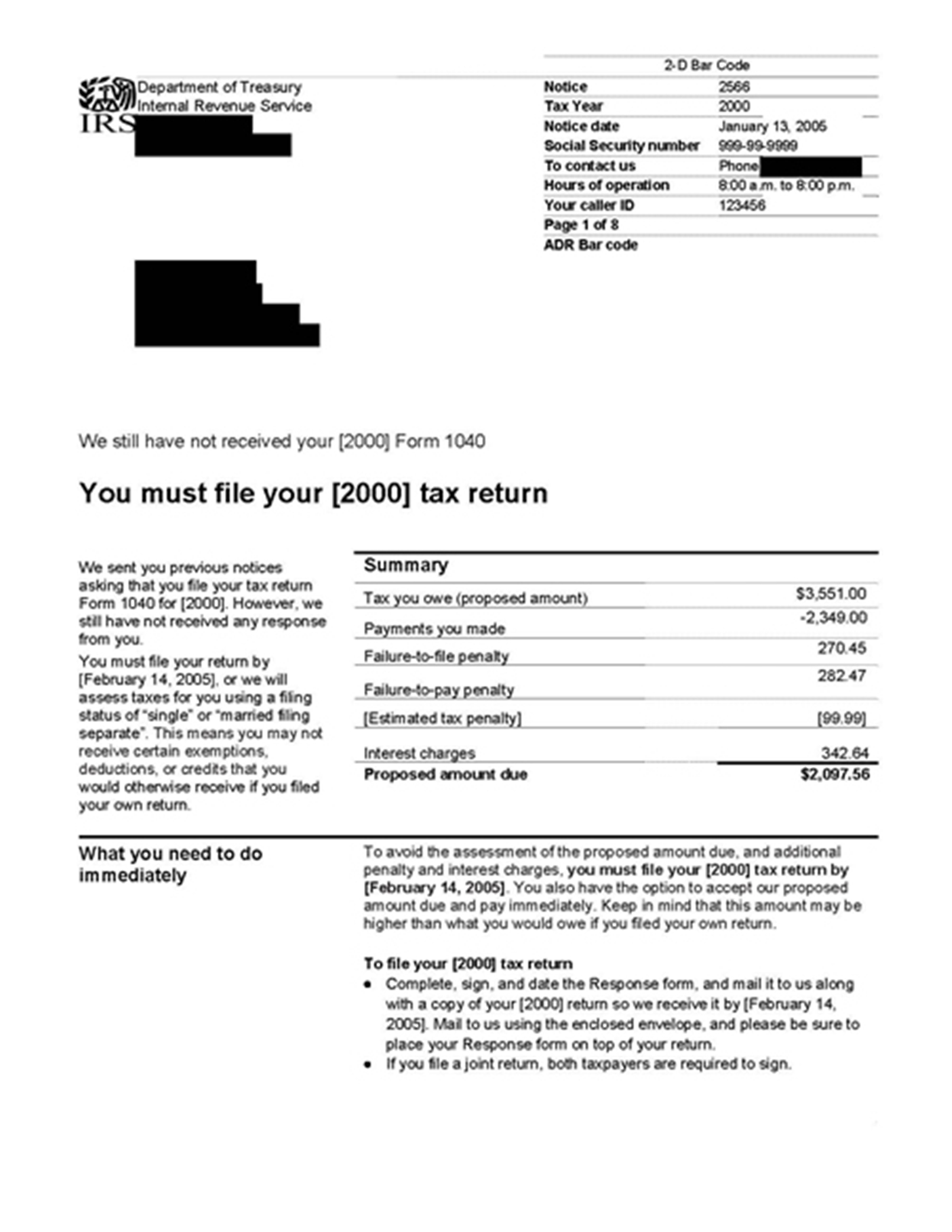

Letter 2566 From The Irs Tax Attorney Steps Taxhelpaudit Com

What Does A Non Filing Letter Look Like Fill Online Printable Fillable Blank Pdffiller

Understanding Verification Ppt Download

Irs Transcripts Online Types Of Transcripts And How To Request Them Marca